Resources Designed to Help Position You for Success

Explore our free resource library for insights on maximizing your business’s value, staying ahead of the curve, and creating a strategic roadmap for selling your business.

eBook: Selling With Confidence

You’ve built a business that you’re proud of—now it’s time to get the maximum return on the value you’ve created. We’ll walk you through each step of the selling process and answer frequently asked questions so you can sell with confidence when the time is right.

Whitepaper: How to Stay Ahead of the Curve

What’s the key to keeping your competitive edge, no matter the economic condition? Like sailing or catching a wave, it’s all about knowing how to position yourself so you can catch and ride market fluctuations to your advantage.

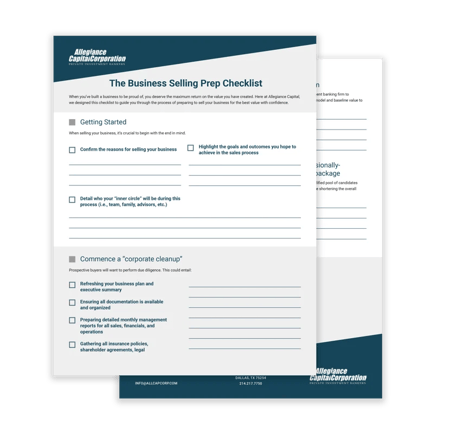

Email Course: Everything You Need to Sell Your Business

For many, selling your business is a once in a lifetime opportunity. In this course, we’ll cover everything you need for the transaction, such as preparing for an audit, understanding market dynamics, and finding the perfect buyer. Enroll to get bonus resources such as the Selling Your Business checklist and eBook.

Explore the Blog: Everything You Need for Your Next Step

Newsletter: The Next Steps Newsletter

Subscribe to our free monthly newsletter for tips to run, scale, and when the time is right sell your business with confidence.

Frequently Asked Questions

Disclosure is at your discretion. Naturally, there will be some individuals whose involvement in the process will be critical, but they don’t need to be involved in the preliminary stages. More often than not, will be team members that the acquirer will want to retain post-transaction.

There doesn’t have to be a negative impact. Indeed, it’s quite likely that many of your employees will be asked to stay on to ensure the continuity and continued success of the business. Often, employed family members and key team members are the ones who provide continuity during the transition period. Depending on their positions, responsibilities and desire to remain with the company, you can negotiate their stay with an employment contract. These are all part of the conversations to be held with the acquirer while conducting due diligence. Through discussions and the offering documents (CIM or CIP), the importance and relevance of this issue will be clearly communicated to the acquirer.

Our founder David Mahmood believed that those who plan ahead are more successful than those who don’t. Or, stated another way, it’s better to be proactive than reactive. You should know what your options are and continue evaluating the marketplace for a potential sale at all times. That’s what the corporate development teams of large corporations do for their companies. That’s the service we provide to the lower middle market. You don’t necessarily need to do a transaction to consult with an M&A specialist, but you should know your options. You don’t have to sell 100% and walk away. There are deal structures where you can take some chips off the table, reduce your risk, maintain some ownership but assign responsibility for managing the business to someone else. You can have the best of both worlds without all the financial responsibility if you find the right company to partner with.